Introduction

New kingdoms were established in the early mediaeval period. There were both large and small towns founded with the new monarchy. The majority of the settlements were close to a river or a body of water, making it simple for traders to sell their goods there. In the beginning, the rulers taxed the land and captured a certain percentage of the peasants’ harvest. The countryside and rural regions were where it was most common to witness people cultivating their land. The rulers discovered new sources of taxes with the emergence of new towns and rich cities. They began taxing business owners and dealers. Along with the growth of new cities, trade also prospered.

Foreign traders came to purchase and sell their wares, and in order to do so, they were required to pay taxes and customs fees on those goods. Small mandis and hatas, where people from neighbouring villages flocked to sell and purchase goods, may be found in villages. There were streets populated by various craftspeople, including potters, sugar producers, carpenters, blacksmiths, and toddy manufacturers. Samantha erected fortified palaces in the towns and imposed taxes on artisans, traders, and goods during the early period and Zamindars during the later mediaeval era. They occasionally gave local temples the authority to collect taxes.

Taxation for traders

In the early mediaeval era, taxing traders was a crucial way for governments and kings to raise money. Customs duties, often referred to as portoria or teloneum, were the main type of taxes and were imposed on goods entering or departing a certain area. Customs officials posted at ports or along trade routes would frequently collect this charge, which was assessed at a predetermined proportion of the value of the goods being traded.

Trade had a significant role in the governance of the Mauryan kingdom. Trade on land and at sea was significant. We may read about tariffs on the movement of products in Kautilya’s Arthashastra. For the supervision and collection of taxes on the trade routes, employees were assigned.

Due to an increase in commercial activity during the Gupta era, the banking system under the Chief Banker’s management improved. Because weavers and printers had to pay half the cost of their products in taxes, traders were subject to substantial tax rates. Taxes had to be paid to the king by several percent.

In addition to import duties, traders had to pay various taxes, such as the poll tax, which was a set sum paid by each individual, and the hearth tax, which was dependent on the number of fireplaces in a home or company.

Trade flourished throughout the Mughal era, and there were three levels of trade:

- Local trade

- Inter-Regional trade.

- Foreign trade.

Some types of taxes were levied at each of these levels. The tax levied on goods was not uniform; it varied depending on the value of the commodity. The traders who engaged in overseas commerce were subject to the majority of taxes. The Mughal traders were so wealthy that they could afford large properties and a luxurious lifestyle. At that time, even nobles received loans from powerful merchants, who also contributed a sizable share of taxes to the emperor and participated in governance. Despite the impression that the emperor’s taxation of merchants was mild, they nevertheless had to pay high taxes to the local chieftains.

Jahangir was one of the emperors who eliminated the customs taxes on goods traded with Kabul and Qandahar. Indian trade with West Asia experienced a golden age during the Mughal era.

Manufacturers’ taxes

In the mediaeval kingdom, there were separate taxes for sectors and manufacturers. A weaver in Rajasthan was required to pay one man of yarn per year. One rupee is to be paid annually on each carding bow by the cotton carder.

Weavers in Maharashtra were required to pay a tax of one-fourth of a taka per loom. A barber in Vijayanagara was required to pay 1 visa each day. A cobbler in Rajasthan was required to provide a pair of shoes every month, while producers of soap and oil were required to pay a predetermined percentage of their sales as tax. In the Vijayanagara kingdom in south India, blacksmiths, goldsmiths, silversmiths, and carpenters were all required to pay 5 panama every year.

Taxation of trade income

Income from trade taxes was the second-largest source of revenue for emperors during the mediaeval era. The land tax and agricultural taxes were the main sources of income for the mediaeval kingdoms. The emperor took control over half of the cultivation during the Mughal Empire.

Emperors levied taxes on a wide variety of goods and industries. Both kinds and cash were used to pay these levies. Jaggery, oil, cotton, dye, thread, clothing, salt, coconut oil, butter, and many more items were subject to taxes in kind in Rajasthan in the tenth century. Earlier taxes were mostly paid in kind. All such taxes were collected by the local zamindars and samantas.

Summary

One of the earliest procedures carried out by any government is taxation. Indian monarchs and chieftains levied taxes on land, agriculture, and trades from the Ancient through the Mediaeval periods. The local chieftains and samantas used the taxes from the Market as a source of revenue. Each region had its own tax system; some accepted payments in certain forms, while others only accepted cash. Numerous Indian societies had a history of being traders, and trading was the foundation of their entire way of life. During the Mughal era, a number of large merchants rose to prominence who engaged in overseas commerce and amassed enormous fortunes. Local groups including the banjaras, Chhetiars, Marwari Oswals, Hindu Baniyas, and Muslim Bohras were small traders.

Frequently Asked Question

Q1. What was Chauth and Sardeshukhi?

Ans: Shivaji introduced the Chauth and Sardeshmukhi land tax. Chauth and Sardeshmukhi were equal to one-fourth and one-tenth of the total amount of goods produced in the region, respectively.

Q2 Why did Kabul and Qandahar grow in importance as trading hubs in the sixteenth century?

Ans: Because both of these places were on the silk road and produced high-quality dry fruits, carpets, and horses, they gained political and economic significance.

Q3. What do you mean by guilds?

Ans: Guilds were groups of dealers and businesspeople that looked out for one another’s interests. To safeguard the traders, guilds were established, and they had an impact on the emperor’s court.

Mission Statement

Mission Statement

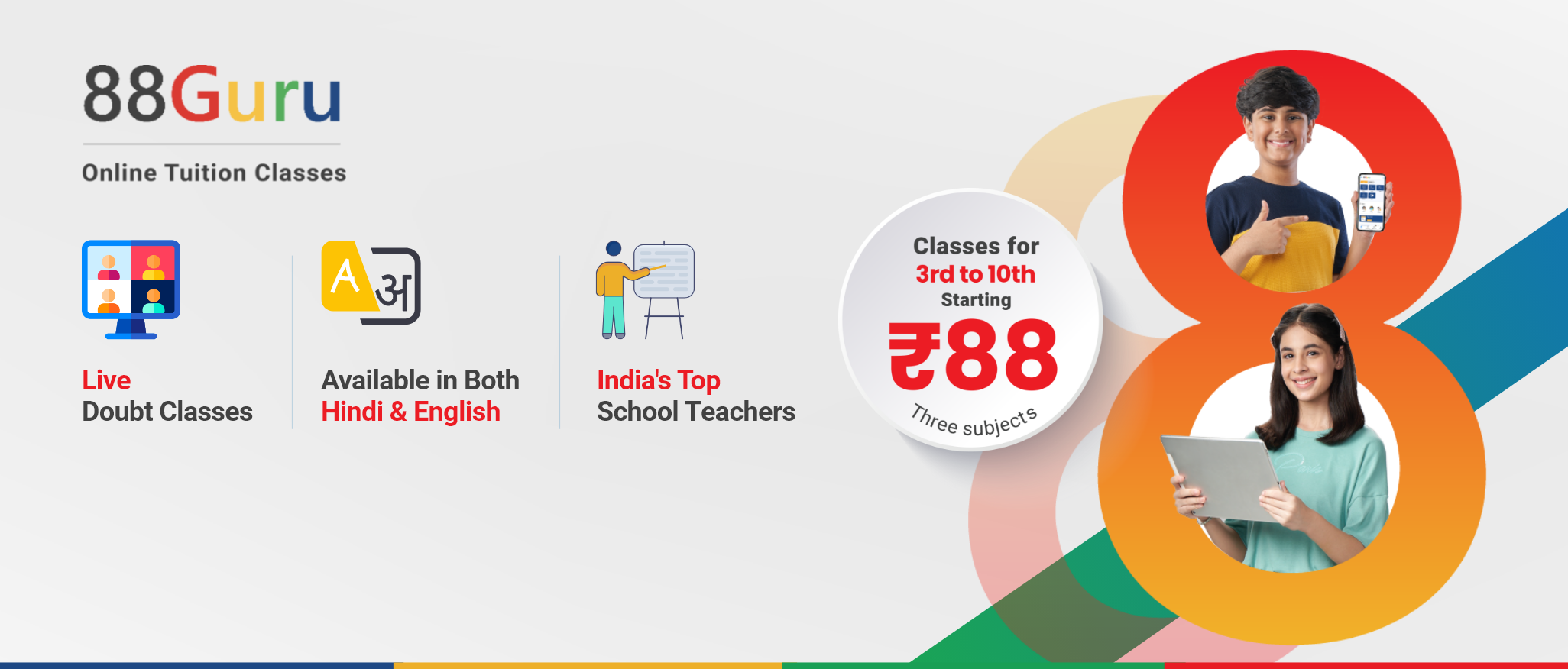

“Empower every student to achieve full potential”

88Guru has been established with the social objective of making quality video-based learning material available to all Indian students. Technology, Connectivity and Social Media are rapidly changing the world of Education and we wish to lead the transformation of the tuition industry in India.

88Guru is the perfect complement to the current tuition model. 88Guru creates a wonderful opportunity for children and parents to bond while engaging in a valuable learning activity. It also provides the complete curriculum at your fingertips for those moments when you need some help at short notice. We believe that this mode of tuition could be transformational, adding hours to a child's day while providing complete control over the learning process.

Every course is taught by the best teachers from India's top schools and conducted in an engaging manner to keep students involved. The e-learning process consists of video-based instructions, computer-graded assignments, and a dashboard which allows the student and parent to track progress.